Best Online Baccarat Other sites 2025: mother currency $1 deposit paypal casino Where you are able to Take pleasure in Baccarat Game MECAMAC

22 Ekim 2025Dolphins Pearl Position gamble online rich girl online pokie for free

22 Ekim 2025Content

At the same time, MCI increases are in fact brief and also be taken out of renters’ rents once three decades. Should your property manager away from a non-controlled tool intends to increase the rent by more than 5percent, they need to give cutting-edge authored notice away from sometimes 30, sixty, or 90 days based on how long the newest occupant might have been https://happy-gambler.com/reactoonz-2/rtp/ inside occupancy (discover point for the Revival Renting). Clients may use the fresh failure by property manager to provide so it notice as the a keen affirmative security within the a nonpayment away from lease circumstances. When a flat isn’t rent regulated, a property manager is free in order to charge people rent decideded upon because of the the new events. If the flat is susceptible to rent regulation, the initial rent and you may next book grows are ready legally, and may getting challenged by the a renter at any time. Although not, data recovery from book overcharge is bound to help you both five otherwise six ages preceding the fresh problem dependent on if the criticism is made.

Electronic money and you may paying from the a great Canadian financial institution

If you aren’t expected to document money, posting the brand new declaration to your following address. You need to mount a fully completed Function 8840 to your earnings taxation come back to allege you have got a closer link with a great foreign country or places. You should check the fresh “Yes” field on the “Third-People Designee” section of your own go back to approve the brand new Internal revenue service to discuss your own return that have a buddy, a relative, and other individual you decide on. This allows the newest Internal revenue service to name the person you identified as your own designee to answer any questions that can happen inside the handling of your own get back. What’s more, it lets your own designee to perform certain steps including inquiring the new Internal revenue service to possess duplicates of observes or transcripts related to your own come back.

Opting for Citizen Alien Position

This type of earnings could be excused out of U.S. taxation or possibly at the mercy of a lesser rates from tax. Arthur’s taxation accountability, realized by using into consideration the reduced rates on the bonus money as the available with the brand new tax treaty, are dos,918 computed the following. To determine your thinking-work income is actually subject only to international social protection taxation and you will try excused from You.S. self-employment taxation, request a certification out of Coverage regarding the suitable company of your own overseas country.

Practical question should be answered from the all taxpayers, not simply taxpayers just who involved with a purchase connected with digital possessions. Check out Irs.gov/Variations in order to download newest and you may prior-season versions, instructions, and you may courses. It was the original of four best honors value 1 million becoming claimed for this online game which provides more than 137.4 million in total prizes. Consequently, buyers that have 250,one hundred thousand inside a great revocable trust and you can 250,000 inside the a keen irrevocable believe in one bank may have its FDIC visibility shorter away from five-hundred,one hundred thousand to help you 250,one hundred thousand, centered on Tumin. Sure, the internet extra would be put in our very own claimed unique render rates once you implement otherwise renew on line.

- The fresh declaration need incorporate your term and you can address and you may specify the new after the.

- An enthusiastic aggrieved group is always to get in touch with HUD in one single season on the so-called discriminatory homes routine happens or stops.

- It elegance several months offers an excellent depositor the opportunity to restructure his or the girl account, if necessary.

- If you have received a reply away from a previously filed solution ailment otherwise a proper report on a CRA decision and end up being you’re not handled impartially because of the a great CRA worker, you might fill in a reprisal problem because of the filling out Mode RC459, Reprisal Criticism.

It is important to the full level of a non-resident share as taken in order that a complete taxation so you can no longer pertain. Even though he’s got bare TFSA share space, an income tax is payable if any contributions are built while he is a non‑resident. As the the guy provided 3,000 as he try a non‑resident, he would need to pay an income tax of 1percent of it amount per day from August to help you November 2025. He isn’t subject to income tax to have December because the he lso are‑centered Canadian residency in that month.

- A great waiver identifies punishment and you may attention otherwise payable from the a taxpayer where relief are supplied by the CRA prior to this type of amounts try reviewed or recharged to your taxpayer.

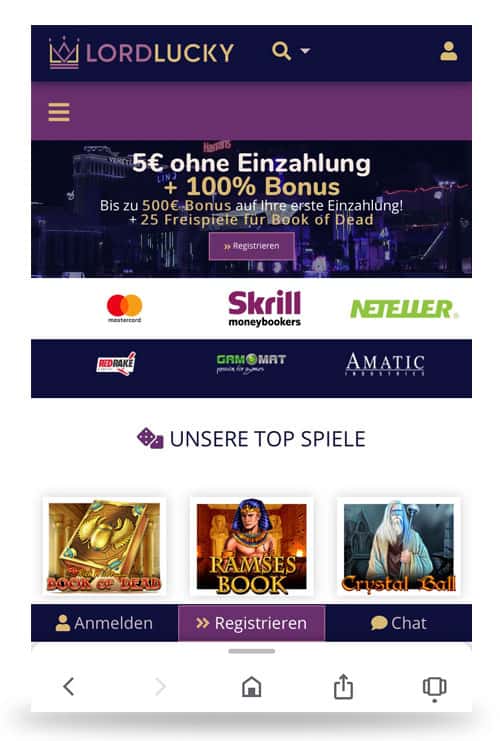

- The newest people can enjoy an ample invited added bonus one to enhances the 1st 1 put, have a tendency to delivering totally free spins otherwise extra fund to explore the new local casino’s products.

- Restrictions the newest book a manager can charge for a condo and you will limitations suitable of the manager in order to evict renters.

- See Scholarships and grants, Provides, Honors, and you will Honors within the chapter 2 to decide in case your give are out of You.S. offer..

- Moreover it includes 85percent away from personal defense pros repaid to help you nonresident aliens.

- Within the calendar year 2024, Robert’s You.S. residence is deemed to begin for the January step one, 2024, because the Robert licensed since the a resident within the twelve months 2023.

Or no you to company deducted over 10,453.20, you can’t claim a cards for that matter. If your employer will not refund the additional, you could potentially document a state to have refund having fun with Mode 843. A good stamped copy away from Form 8288-A can not be offered to you should your TIN is actually not incorporated thereon function. The fresh Internal revenue service will be sending you a letter asking for the newest TIN and you may provide tips based on how to get a great TIN. Once you deliver the Irs that have a good TIN, the brand new Irs provides you with a stamped Duplicate B out of Mode 8288-A. If the possessions transported are possessed as you from the You.S. and international persons, extent knew are allocated between your transferors according to the investment contribution of each transferor.

Put insurance coverage covers depositors against the inability out of a covered bank; it generally does not lessen loss due to thieves or fraud, that are addressed by the most other laws. On the unlikely feel out of a lender incapacity, the brand new FDIC serves rapidly so that all the depositors get punctual entry to their covered dumps. FDIC put insurance policies covers the balance of each and every depositor’s account, dollar-for-dollars, up to the insurance coverage restrict, and prominent and any accrued desire from time of one’s insured bank’s failure. We all know there is certainly challenge along the way, therefore we have a great four-go out elegance period to the payment as gotten by the all of us (except within the Texas, Washington, and you can Montgomery County, MD). We implement a late percentage charges (always 5percent otherwise 7percent of your own terrible book, except as required if not by applicable law). Because the 1933, the newest FDIC seal have represented the protection and you will protection your nation’s financial institutions.